| Regulatory Requirement | Compliance | Solution Capability |

|---|---|---|

| Video to be recorded | Live streaming and recording of video call | |

| Capture photograph of customer | Manual and automated photo capture during the video call | |

| Offline Aadhaar XML | Offline Aadhaar XML or Encrypted QR during or prior to the call | |

| Aadhaar XML/QR not older than 3 days | Offline Aadhaar/QR generation timestamp verified for file age | |

| Redact Aadhaar Number | Aadhaar number masked in image and video | |

| Clear image of PAN | Image capture and image quality assessment done on PAN | |

| PAN verification | PAN verified against issuing authority (NSDL) in real time | |

| Live location of customer | Lat/Long geolocation captured and verified to be in India | |

| Customer photo matched with the ID photo | Face matched against Aadhaar/PAN with quality assessment | |

| ID details matches with the application | OCR of ID data matched against application data | |

| Random sequence/questions | Configurable dashboard/API to randomize questions | |

| Liveness checks to prevent spoofing | Agent checks and voice token based liveness checks | |

| Concurrent audit to establish integrity | Dashboard allows for maker-checker process and audit checks | |

| Real-time, secure, encrypted | Live and secure video call encrypted using AES 256 | |

| Video quality to verify customer beyond doubt | Requires just 50 kbps bandwidth to establish a video call | |

| Software and security audits | Regular VAPT checks using internal/external auditors | |

| Video call triggered from RE domain | On premises solution or on-cloud using your domain to initiate call | |

| Activity logs and credentials to be preserved | Activity and data logs are preserved as part of the call | |

| Video stored safely and securely with timestamps | Stored on-premises or on our cloud (encrypted) with timestamps | |

| Use of AI technologies for validations | Cutting edge AI platform matured over 6 years developed in-house |

- Platform

Text Recognition (OCR)

Extract, classify, compress, rotate, convert and moreFace Recognition

Verify liveness, authenticate, match and moreVideo Verification

Create your own assisted or unassisted onboarding flowsID Verification

Verify IDs against issuing authorities to eliminate fraudAadhaar Services

Aadhaar offline, Aadhaar masking, Aadhaar eSign and moreData Protection

Turn data protection compliance to competitive advantage

- Solutions

Digital KYC

Allow customers to onboard themselvesVideo KYC

Assisted by Agents over a video callUnified KYC

Reimagine customer onboardingAadhaar esign

Paperless digital siganture using Aadhaar on any deviceAadhaar Masking

Remain compliant with Aadhaar maskingAadhaar Offline

Verify aadhaar users instantlyVideo PIVC

Compliant pre issuance verification (PIVC)IRSF Fraud

Prevent IRSF, Robo and Wangiri fraudIdentity Fraud

Prevent fraud at the point of onboardingFace Liveness and Authentication

Replace passwords with live face across devicesFace Attendance

Touchless face attendance on mobile devicesDigital KYC Wallet

Store and share your KYC docs securely with anyone

- Developers

- Company

About

Our story, what we do, why we do, how we do and moreCareers

Join us to learn, grow & touch the lives of a billion peoplePatents

Think and build game changing tech that truly mattersPress

Read what others are saying about frslabsAwards

A glimpse of the many awards that we have wonBlog

Our thoughts on problems, solutions and everything elsePartnership

If you can sell what we build, we'd love to talk

- Book Demo

The complete video onboarding toolkit

Onboard your customers at the comfort of their own homes. Give them the ultimate experience to sign up to your services in the most trusted manner.

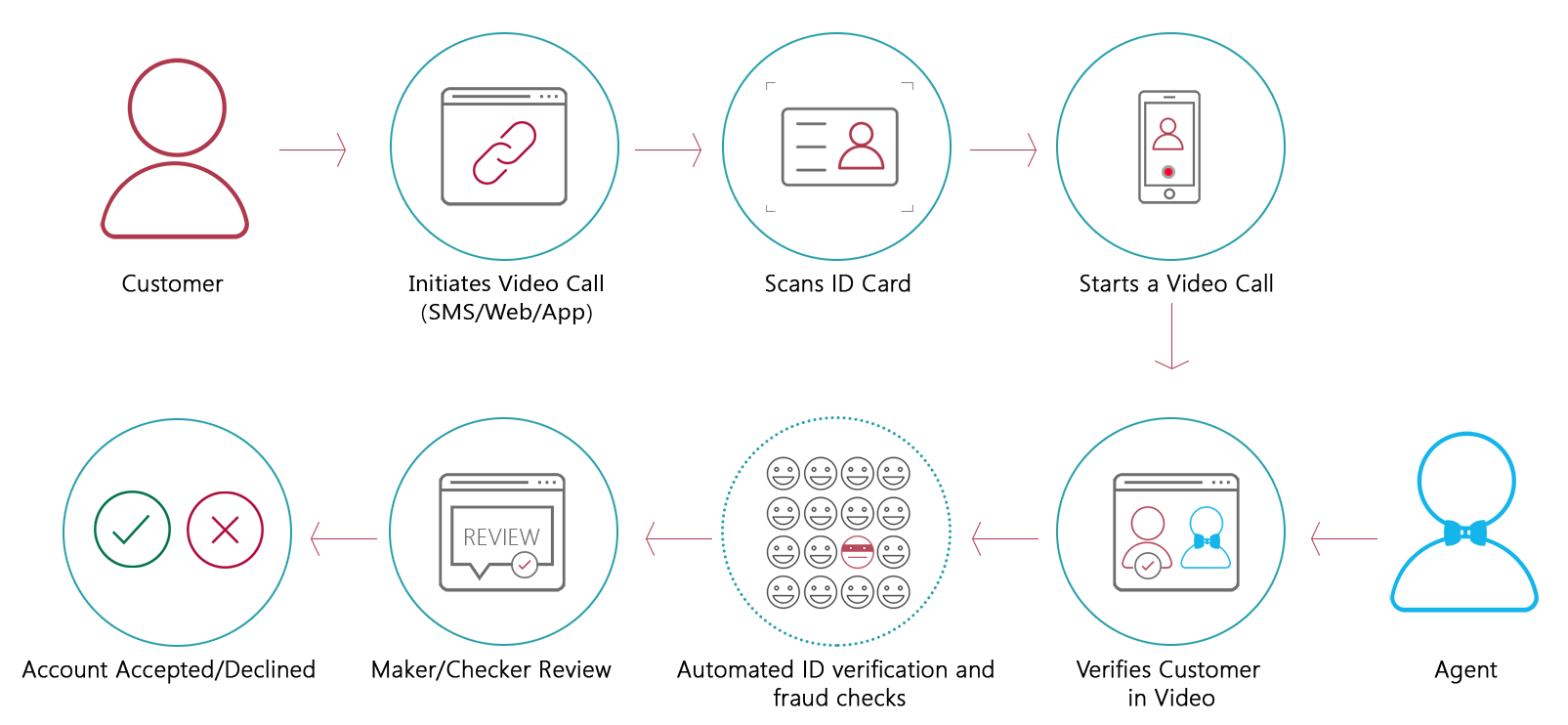

Assisted Video KYC

User is assisted by an Agent over a video call to complete the verification steps. Useful where regulations mandate organisations to carry out KYC capture and verification over a live video call before onboarding the User.

Onboard customers

In minutes without meeting face to face

The recent regulatory approvals from RBI, SEBI and IRDAI removes the need for regulated entities to meet customers face to face or collect paper copies for KYC verification. Video KYC is considered as full KYC without restrictions, thereby increasing convenience and reducing costs dramatically.

Video KYC as it should be

Simple and secure live video call

The customer can, through a stroke of a video call, chat directly with a Banker, provide all the identity documents to verify who they are and complete the account opening steps in a few minutes. And the video streamed live to the Banker.

Learn moreVideo KYC as per regulations

ID check. Face liveness check. Location check and more

The Bank official can, through the Video KYC dashboard, capture face, capture ID and geo location of the customer. And as part of verification the ID is verified against issuing authority, face is matched against Aadhaar and PAN, geo location is verified to be within India and liveness checks ensure that the video call is live and authentic.

Learn moreAadhaar as per regulation

Aadhaar offline or Digilocker

The only permitted ID for video KYC is Aadhaar as per regulations. While banks can do OTP based eKYC or Aadhaar Offline (XML and Encrypted QR), all other regulated entities can only do Aadhaar Offline. We provide a seamless Aadhaar Offline process before or during the video call. And also success and failure paths.

Learn moreConfigurable Video KYC flow

Agent initiated or Customer initiated.

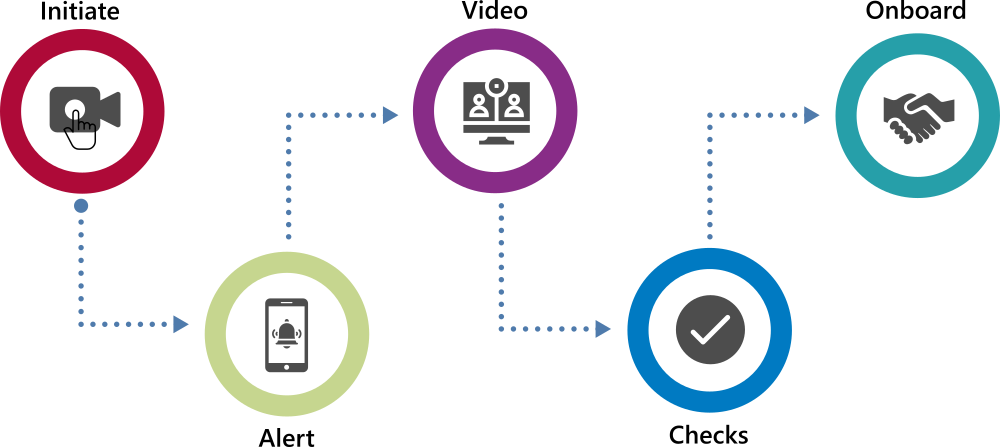

There are typically two possible workflows to initiate a video call. The Agent can initiate a video call from the Atlas dashboard sent as a web link to the customer or the customer can initiate the video call from your own mobile or web Application.

- Initiate Call – Agent logs into Atlas to trigger an SMS/Email from the Dashboard (entering the customer mobile number, email and customer reference ID as input).

- Alert Customer – Customer receives an alert as SMS and Email. The customer clicks the link – Accepts Terms and Conditions, Location Verified (India), Customer completes Aadhaar Offline (Aadhaar age validation success), Starts video call.

- Video Call – Once the call is connected, Agent walks the customer through with the KYC verification – Face capture, PAN capture, random questions and other verifications can be done by the Agent. Agent completes the necessary steps as per your need and ends the Video call.

- Checks – Agent/Manager can now review the Video call (maker checker process) to Accept or Reject the call. For each of the decisions made, the status will be updated in the Dashboard for the record.

- Onboard – Once the Video verification is completed, the next steps of provisioning the account will follow from the backend/CRM/Core systems.

- Initiate Call – Customer can trigger a video call from your web or mobile applications that has our SDKs integrated into your Application. Customers will verify their location and complete Aadhaar Offline prior to initiating the video call with an Agent.

- Alert Agent – When customer initiates a video call, an Agent logged into the Atlas Dashboard will receive a call alert. If an Agent is not available to take the call, the system keeps attempting for 90 seconds and then passes a message that “No Agents are available to take the call at the moment”. The customer can try again later or the Agent can initiate the call at a later time.

- Video Call – Once the call is connected, Agent walks the customer through with the KYC verification – Face capture, PAN capture, random questions and other verifications can be done by the Agent. Agent completes the necessary steps as per your need and ends the Video call.

- Checks – Agent/Manager can now review the Video call (maker checker process) to Accept or Reject the call. For each of the decisions made, the status will be updated in the Dashboard for the record.

- Onboard – Once the Video verification is completed, the next steps of provisioning the account will follow from the backend/CRM/Core systems.

Video KYC dashboard

A ready to use plug and play portal

The Atlas Video KYC dashboard provides a seamless way to connect the Agent and the customer through a video call and collates all of the ID documents and checks in one place with full audit trail. With all of the heavy lifting done by our AI engine to verify the customer, the Agents (maker and checker) can focus on results and not on the process.

Learn moreVideo KYC Deployment

At your premises or on secure cloud

The video streaming is triggered from the domain of the regulated entity. We provide an easy web link that is sent via SMS and Email or a mobile SDK that gets integrated into your existing mobile App to trigger the video call. The entire solution can be deployed on-premises or on our secure cloud or on your private cloud. location check and liveness checks. It can link multiple internal and external datasets to identify high risk and fraudulent customers at the point of onboarding.

- The Video KYC software to be deployed should undergo vulnerability, security and audit validation to ensure robustness and end to end encryption.

- Ensure that the video call is seamless, real-time, encrypted and secured between the customer and the official conducting V-CIP.

- Ensure that the quality of the video is adequate to establish identification of the customer beyond doubt.

- To avoid spoofing and fraudulent attempts, the video call should originate from the domain of the regulated entity.

- Ensure that the customer is physically present for V-CIP.

- Ensure the V-CIP is done by a trained official (and not outsourced).

- Capture Aadhaar Offline and ensure that the document is not older than 3 days.

- Capture the PAN of the customer and verify it against the issuing authority.

- Capture a live photo of the customer and match it with Aadhaar and PAN photo.

- Ensure that the questions are varied to ensure liveness and avoid spoofing.

- Sufficient liveness checks are carried out by the official conducting V-CIP.

- The video call is subjected to maker-checker process to ensure concurrent audits before the account being fully operational.

- The video kyc recording, along with the metadata and call record are stored safely bearing the date and time of the call.

The regulator has provided the following guidelines for Video KYC deployments.

Concurrent audit is a broader term which is covered in depth in the RBI circular dated 16 July 2015. The regulator defines concurrent audit as follows:

“Concurrent audit is an examination which is contemporaneous with the occurrence of transactions or is carried out as near thereto as possible. This audit is essentially a management process integral to the establishment of sound internal accounting functions and effective controls and setting the tone for a vigilant internal audit to preclude the incidence of serious errors and fraudulent manipulations. A concurrent auditor may not sit in judgement of the decisions taken by a branch manager or an authorised official. This is beyond the scope of concurrent audit. However, the audit will necessarily have to see whether the transactions or decisions are within the policy parameters laid down by the Head Office, they do not violate the instructions or policy prescriptions of the RBI, and that they are within the delegated authority.”

Furthermore, in the revision shared by RBI on 18 September 2019 (Annex) covers the remit of the auditor for concurrent audits which includes KYC/AML as “Adherence to KYC / AML guidelines including monitoring of transactions in accounts …”

Therefore, the interpretation of concurrent audit should be that of thorough examination of the Video KYC process, continuous audits and best practices laid down by the Regulated Entity in line with the V-CIP regulations set out by RBI.

Video KYC FAQ

What you need to know beyond the basics

At its core, much like a phone call, the technology enables video signalling between two peers or devices for the real-time exchange of audio, video and data. Once the peer to peer connection is established, the data is streamed live through our communication server that can be hosted on our cloud server or on your premises. Once the video call is established, it allows the official from your company (Agent) to complete the checks that are needed to establish the identity of the customer (KYC).

Yes. You can use our Atlas Video KYC dashboard or our APIs to trigger a link via SMS or Email which when clicked would allow the customer to do a video call from a desktop browser or mobile browser with your Agent. Alternatively, you can integrate our native mobile (Android and iOS) SDK into your mobile applications that will allow your customers to make a video call directly in your mobile app. In both cases, our dashboard plays an integral role for the Agent to complete the KYC.

Our Video KYC dashboard is a feature rich tool to initiate video calls by Agents, accept video calls from customers, complete the necessary steps needed to verify the customer during the call, accept and verify identity documents and configure the KYC flow to your exact needs. A summary of the dashboard features are as follows:

- Supports Offline Aadhaar KYC: Extracts data from Aadhaar XML or Aadhaar Encrypted QR as prescribed by the regulator prior or during the live video call with the Agent.

- Supports capture of KYC compliant photograph (automatically crops and compresses the captured image at the time of storage).

- Artificial Intelligence and deep learning technologies allow for accurate face matching of the customer against the photograph obtained from the ID.

- Supports real time ID verification against issuing authorities for PAN as prescribed in the master KYC regulations.

- Supports masking or redacting of Aadhaar image that are displayed to the official during the live video session.

- Supports geo tagging and time stamping video with secure and real time streaming of videos in full compliance with the regulator.

- Supports concurrent audit of the video call through a maker-checker process for verification before the account is fully activated

- Supports creation of users and roles (maker, checker, admin) within the dashboard.

Yes indeed. From the Admin panel, you can create users with Maker or Checker roles to authorise specific functions within the dashboard. This complies with the concurrent audit as specified by the regulator. The role of the Checker is to ensure (double check) that the Video KYC policies laid down by the organisation is followed fully by the Maker and then to Approve or Reject the application based on the information submitted by the customer and the automated checks done by the system.

We support https over TLS 1.2 and our encryption is RSA with AES 256. The data transferred between the Agent and the Client is always encrypted. The video at rest is also encrypted.

Minimum network speed required will be 50 kbps at both ends. While the video call will still continue when the network speed reduces during the call, both the Agent and the customer will notice a certain amount of screen freeze or reconnection attempt when the speed drops below 15 kb/s.

If you are fairly new to this technology, we recommend using our cloud service with our dashboard for zero integration to begin with. Your Agents can simply login to the dashboard, initiate calls with

Customers and see all of the data within the dashboard. You can download and store the data permanently in your servers (in-house). As the pricing is per transaction, you minimise the risks of this new

technology until you are ready to scale.

If you are a large Bank or Insurance company with many different product portfolios and hundreds of Agents with thousands of checks to be done, we recommend taking the effort to deploy our solution

on-premises. This gives you the flexibility to add customisations that are needed for your organisation and pay a fixed annual fee for the software so you can do unlimited checks or add any number of Agents

without worrying about increasing opex as you scale.

Our Video KYC solution brings with it over ten years of frugal innovation (with five patents pending) and goes beyond just the video call. We provide a seamless yet robust AI engine to verify the checks despite the possible human bias, error or fraud that could happen at scale with this technology. For instance, we provide additional fraud and anomaly checks to identify potential bad behaviour by the Agent or organised criminals trying to form sleeper accounts only to defraud at an opportune time. As they say, prevention is better than cure, because there is no cure to fraud. A smooth onboarding combined with robust fraud prevention is our unique value proposition.

Ticks all the compliance boxes

Video KYC features that matter.

Live Streaming

Live video streaming with end to end encryption between the host and server.

Video Quality

Good Quality video to establish customer identity beyond doubt.

Live Location

Live location checks to ensure customer is physically present in India.

On Premises

Video connection originate from the domain of the regulated entity.

Aadhaar Offline

Live Aadhaar eKYC or Aadhaar Offline done within the video call.

PAN Verification

PAN card is validated against the issuing authority in real time.

Customer Photo

Live picture of the customer captured and matched against PAN/Aadhaar.

Prevent Spoofing

Configurable random questions to prevent fraud and spoofing attacks.

Video Integrity

Video logs and metadata are preserved to verify the integrity of the process.

Video Storage

Video recording and associated images are stored on premises with time stamps.

Aadhaar Masking

Aadhaar images and Aadhaar displayed in the video are redacted (masked).

Concurrent Audit

Continuous performance, security and audit validations

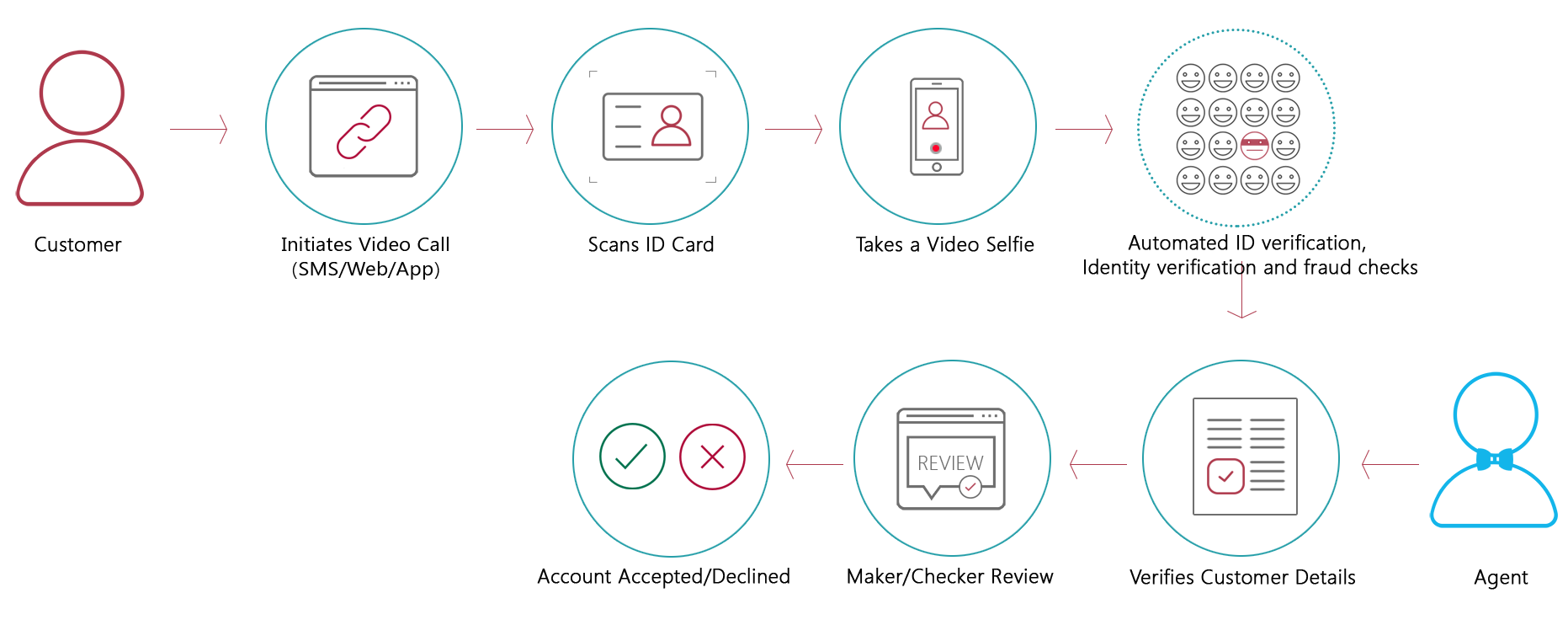

Unassisted Video KYC

Customer completes all the verification steps at their own pace. Useful in less regulated environments or low risk environments where there is sufficient ID proofs and background checks to verify the user.

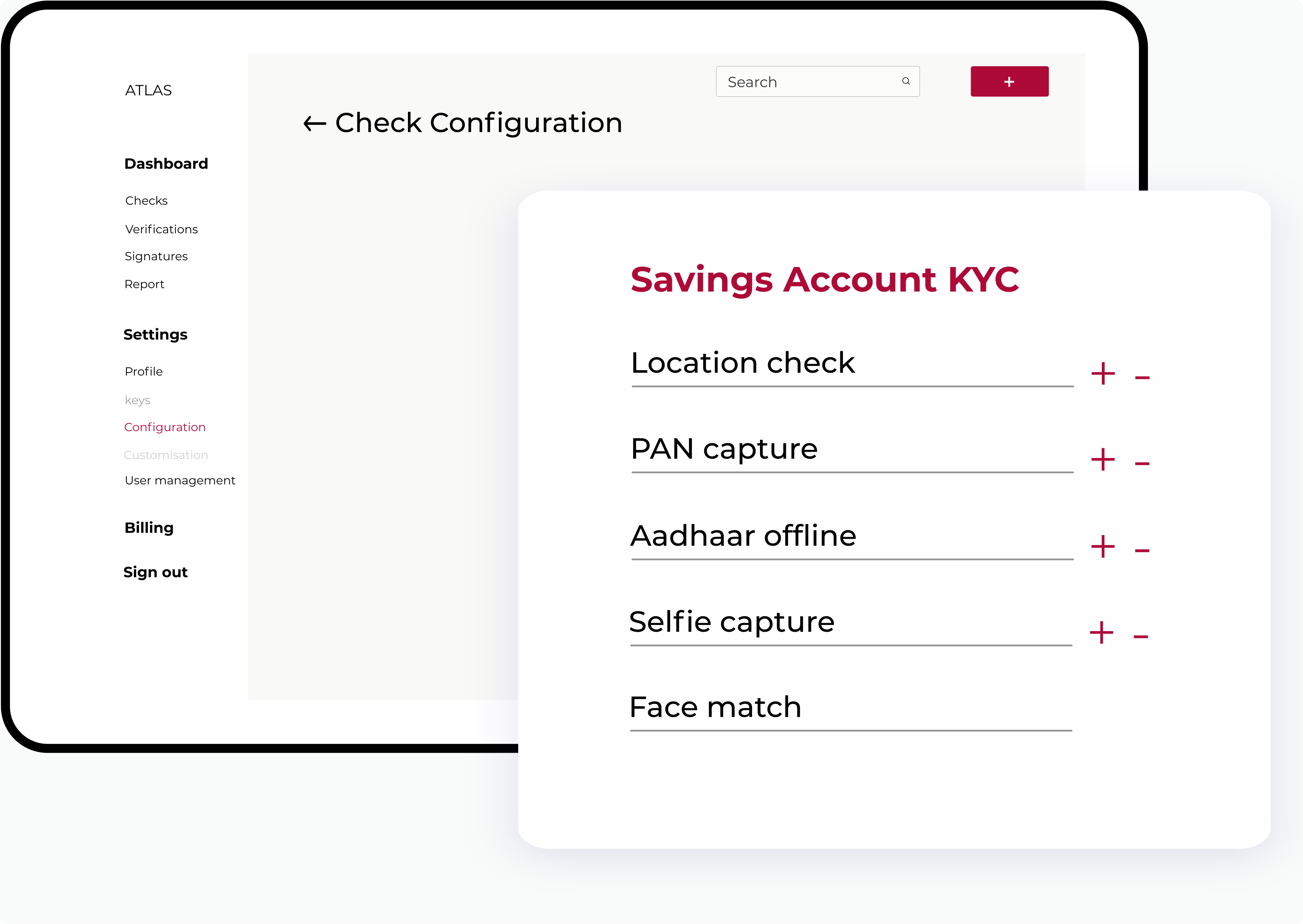

Design any KYC flow

To you exact needs without code.

Our goal is to provide you a platform where you can create the flow just as you need without writing a line of code. You can simply configure the flow, initiate a check and watch the magic unfold.

Learn moreCustomise your KYC screens

Add your own contents and links.

Once you have created your desired KYC flow, you can edit common pages such as Terms and Conditions, Privacy Policy, Consent Page to match your company data and branding.

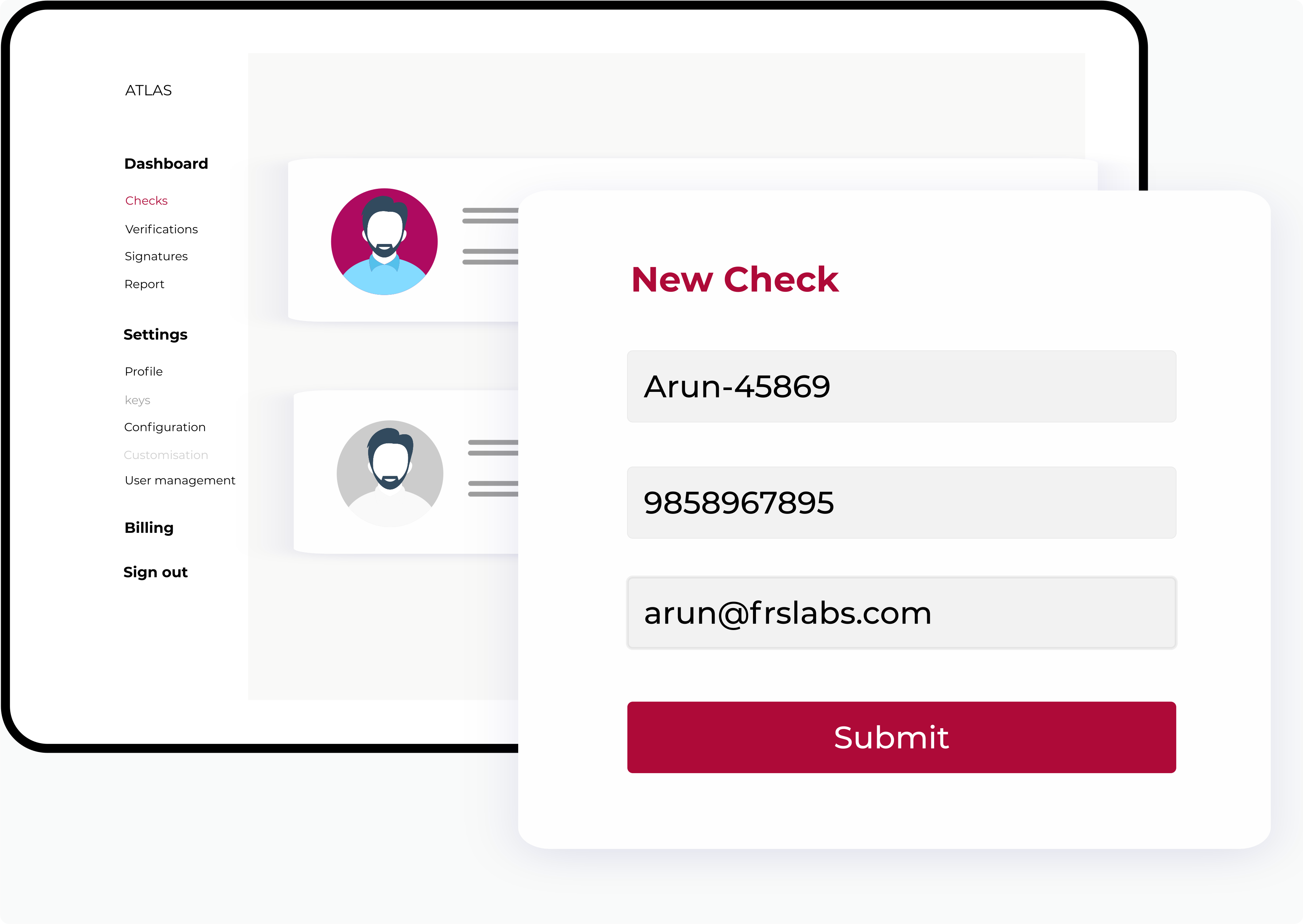

Learn moreEasy to use dashboard

All your checks in one place.

Once you have initiated the verification with a customer, you can view the progress of the check in the dashboard. You can send a reminder or cancel the request from the dashboard without having to write a line of code. With all of the heavy lifting done by our AI engine to verify the customer, the Agents (maker and checker) can focus on results and not on the process.

Learn moreSuper easy steps

Instructions that don't go wrong

Be it capturing the picture of the ID, capturing a video selfie or signing the documents, we have thought of the success path and possible friction points to assist customers to complete the steps with ease.

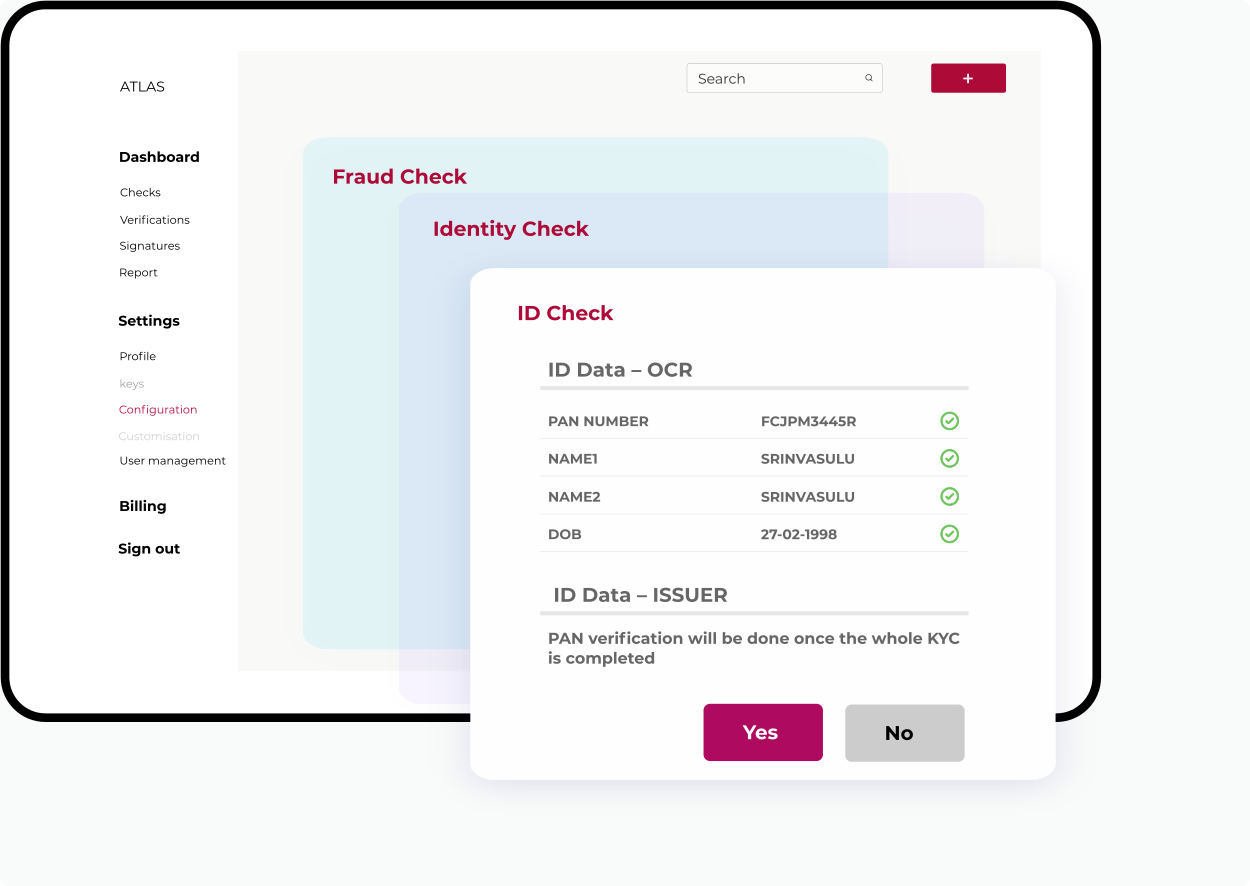

Learn moreMaker Checker verification

Compliance with full audit trail.

Once the customer has completed the verification steps, you can view all of the checks in the dashboard. You can have two level maker-checker approvals to accept or decline the applicants. Besides, you will have a full PDF folio of all of the KYC details which can be stored as a single version of KYC for all your compliance needs.

Learn moreAML Sanctions Screening

Screen customers as per AML regulations

Regulatory Entities (REs) must conduct a check against the Sanctions list when establishing an account-based relationship (such as through Video KYC or face to face) with a customer, as well as on a periodic basis. They should promptly report any connections or links between customers and known offenders to the nodal officer. Utilizing our APIs, name screening can be instantly performed, enabling quick identification of high-risk individuals and businesses. Furthermore, we have the capability to monitor these high-risk candidates on a daily basis, keeping track of any changes and links to updated data sources.

Learn moreSimple API integration

Customer friendly. Developer friendly.

With easy to integrate APIs, you can build your own onboarding flow and only use the APIs as you see fit. For example, if you have a web flow and would like to auto-fill an application using an ID, simply create a screen that allows the user to upload an ID and do an API call in the background to fetch details and populate them in your online form. The customisations are limited only by your imagination.

Tell us your needs

Tell us your needs See how Atlas works

See how Atlas works  Ask us anything

Ask us anything  Build your solution

Build your solution